Exploring the landscape of health insurance plans for expats in 2025, this introduction sets the stage for a detailed examination of key considerations and emerging trends in the realm of expatriate healthcare coverage.

Highlighting the evolving nature of healthcare options for expats, this overview aims to inform and educate readers on the intricacies of selecting the best insurance plan for their needs.

Factors to Consider When Choosing Health Insurance Plans for Expats in 2025

When selecting health insurance plans for expats in 2025, several key factors need to be taken into consideration to ensure comprehensive coverage and peace of mind for individuals living abroad.

Key Differences Between Local and International Health Insurance Plans

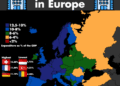

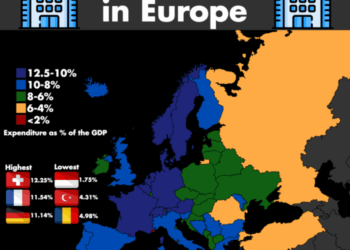

International health insurance plans for expats typically offer broader coverage compared to local plans. They often provide worldwide coverage, including the expat's home country and the country of residence. Additionally, international plans may offer better access to English-speaking healthcare providers, which can be crucial for expats living in non-English speaking countries.

The Importance of Coverage for Pre-existing Conditions

Coverage for pre-existing conditions is highly important in expat health insurance plans. Many expats may have pre-existing medical conditions that require ongoing treatment, and having coverage for these conditions ensures that they can access the necessary care without incurring significant out-of-pocket expenses.

It is essential for expats to carefully review the policy terms to understand the extent of coverage for pre-existing conditions.

Significance of Emergency Medical Evacuation Coverage

Emergency medical evacuation coverage is a critical component of health insurance plans for expats. In the event of a medical emergency that requires specialized treatment not available locally, medical evacuation ensures that the individual is safely transported to the nearest appropriate medical facility.

This coverage can be a lifesaver in situations where immediate medical attention is required, but local facilities are inadequate to provide the necessary care.

Emerging Trends in Health Insurance for Expats in 2025

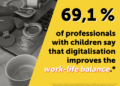

Telemedicine services are revolutionizing the way expats access healthcare, with many health insurance plans now integrating these virtual consultations into their coverage. This allows expats to consult with healthcare providers remotely, saving time and increasing accessibility to medical care.Digital health tools, such as health tracking apps, are also making a significant impact on expat health insurance offerings.

These tools help expats monitor their health metrics, track their fitness levels, and manage chronic conditions more effectively. Insurance providers are recognizing the value of these tools in promoting preventive care and are incorporating them into their plans to encourage healthier lifestyles among expats.Personalized health plans tailored to individual expat needs are becoming increasingly prevalent in the health insurance market.

These customized plans take into account factors like age, medical history, lifestyle, and specific healthcare needs to provide expats with coverage that aligns with their unique requirements. By offering personalized plans, insurance providers are enhancing the overall healthcare experience for expats and improving outcomes.

Integration of Telemedicine Services

Telemedicine services are now a standard feature in many expat health insurance plans, allowing for convenient access to healthcare professionals without the need for in-person visits. This integration not only saves time and money for expats but also ensures timely medical consultations, especially in remote or underserved areas.

Impact of Digital Health Tools

Digital health tools, such as health tracking apps and wearable devices, are empowering expats to take charge of their health and well-being. These tools enable expats to monitor their vitals, track their fitness progress, and receive personalized health recommendations, leading to better health outcomes and reduced healthcare costs in the long run.

Personalized Health Plans for Expats

Insurance providers are increasingly offering personalized health plans tailored to individual expat needs, taking into consideration factors like age, lifestyle, and pre-existing conditions

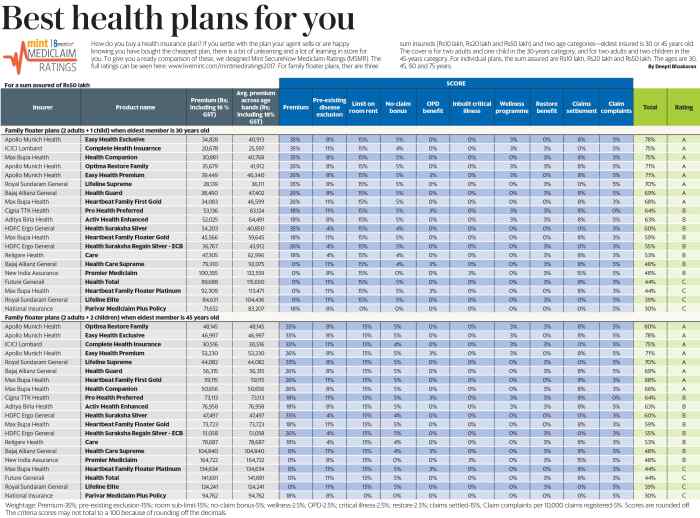

Comparison of Top Health Insurance Providers for Expats in 2025

When choosing health insurance plans for expats in 2025, it is crucial to compare the offerings of different insurance providers to find the most suitable option. Here, we will compare the coverage options, network of healthcare providers, customer service, and claims process efficiency of leading health insurance providers for expats.

Coverage Options

- Provider A: Offers comprehensive coverage including inpatient and outpatient services, emergency medical evacuation, and mental health services.

- Provider B: Focuses on preventive care with coverage for regular check-ups, vaccinations, and wellness programs.

- Provider C: Specializes in international coverage with benefits for expats living in multiple countries.

Network of Healthcare Providers

- Provider A: Has a wide network of hospitals and clinics globally, ensuring access to quality healthcare services wherever the expat is located.

- Provider B: Partners with specific healthcare providers known for their expertise in expat healthcare, ensuring specialized care for expats.

- Provider C: Offers a flexible network allowing expats to choose their preferred healthcare providers within the network or opt for reimbursement for out-of-network services.

Customer Service and Claims Process Efficiency

- Provider A: Known for its responsive customer service team and efficient claims processing, making it easy for expats to navigate their healthcare needs.

- Provider B: Offers a user-friendly online portal for claims submission and tracking, streamlining the process for expats and ensuring quick reimbursements.

- Provider C: Provides personalized support to expats, guiding them through the claims process and offering assistance in multiple languages for better communication.

Future Challenges and Opportunities in Expatriate Health Insurance

In the ever-evolving landscape of expatriate health insurance, there are several challenges and opportunities that are expected to shape the industry in the coming years. From changing global healthcare regulations to the need for innovative mental health coverage, the future of expat health insurance is both promising and complex.

Impact of Changing Global Healthcare Regulations

With healthcare regulations constantly evolving around the world, expat health insurance providers may face challenges in adapting their plans to comply with varying requirements in different countries. This could lead to increased complexity in coverage options and pricing, making it crucial for insurers to stay up-to-date with regulatory changes to ensure expats have access to comprehensive and compliant healthcare coverage.

Innovating Mental Health Coverage for Expats

One of the key opportunities for insurance innovation lies in addressing mental health coverage for expats. Mental health issues are becoming increasingly prevalent among expatriates due to the stress of living in a foreign country, away from their support systems.

Insurers have the opportunity to develop specialized mental health coverage options tailored to the unique needs of expats, providing them with the necessary support and resources to maintain their well-being abroad.

Ensuring Continuity of Coverage for Expats Moving Between Countries

Another potential challenge in expatriate health insurance is ensuring continuity of coverage for expats who frequently move between countries. As expats transition from one location to another, they may face gaps in coverage or difficulties in transferring their insurance plans.

Insurers can seize this opportunity to create flexible and portable coverage options that can easily adapt to the changing needs and circumstances of expatriates, ensuring seamless access to healthcare services regardless of their location.

Last Recap

In conclusion, the diverse array of health insurance providers, coupled with the challenges and opportunities on the horizon, underscores the importance of staying informed and proactive when it comes to securing the best health insurance plan as an expat in 2025.

Clarifying Questions

What are the key differences between local and international health insurance plans for expats?

Local health insurance plans are typically limited to specific regions or countries, while international plans offer coverage across multiple countries, making them ideal for expats who frequently travel or relocate.

Why is coverage for pre-existing conditions important in expat health insurance plans?

Pre-existing condition coverage ensures that expats with existing medical conditions receive the necessary treatment and care without facing exorbitant out-of-pocket expenses.

How does emergency medical evacuation coverage benefit expats in health insurance plans?

Emergency medical evacuation coverage provides expats with access to timely and efficient medical transport in the event of a serious illness or injury that requires specialized treatment not available locally.